Digging Deeper into REITs & InvITs

4th Mar 2024There was a lot of interest in our previous blog – which introduced REITs and InvITs as alternatives to investing in physical real estate assets. Today we are answering some of the common questions which came up and are bound to be useful to all our audience.

How do we invest in REITs and InvITs?

The Methodology for investing in REITs and InvITs is exactly similar to investing in any particular stock in the stock market.

You will need open an account with any stock brokerage or Asset Management company such as Zerodha, ICICI Direct, etc.

They will help you open a DEMAT account if you don’t already have one.

You can invest in the REITs and InvITs during their Initial Public Offerings (IPO) or buy the units directly as you will buy any stock in the market.

What was the return from these investments over last few years?

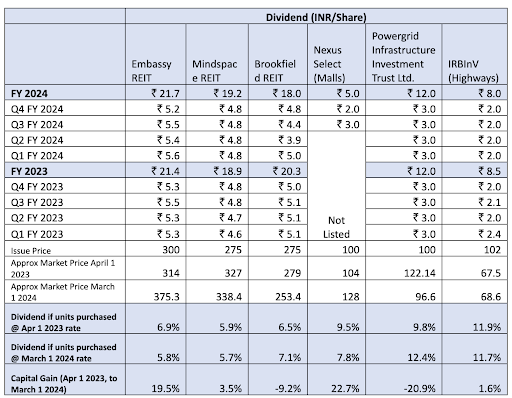

We have collated the dividends and capital gains of some the popular REITs and InvITs below for your analysis and inference.

Please note that Mishree does not provide advice and recommendations for any individuals stock including REITs.

Can REITs and InvITs be an alternative to bank FDs?

Looking at the returns generated simply from Dividends varying from 6% to 12%,

it is logical that some customers will invest in REITs purely from the perspective that they generate a much better return than bank FDs.

The taxation of REITs is a quite complex topic dealt with quite well

HERE, we can assume a rule of thumb estimate that approximately 50% of

the dividend will be taxable at an individual’s tax rate, compared to 100% for interest from Bank FDs.

Despite these benefits of higher returns and lower taxation – there is a matter of variation in the invested capital.

As we can see in the table, some REITs have capital gains as high as 20% whereas some are flat or fallen by as much as 20%.

The better returns do come from higher risks which the investor needs to consider.

What is the risk associated with REITs and InvITs?

The SEBI regulation ensures 90% of revenue is distributed to REIT owners.

Most of the REITs and InvITs are structured through a concept of Special Purpose Vehicles (SPVs) which in turn manage

independent projects including Highways, Malls, etc. The REITs invest or lend to these SPVs which in turn pay dividends or interest to the REITs.

This effectively means that the 90% of the profit is disturbed to investors.

As with any other company, revenue and profit REIT Trusts are tied to the uncertainties of the business.

For example – COVID had a significant impact on the rental income of REITs focused on office space rentals.

The revenue of highway and power infrastructure REITs can be impacted by anything from cyclones to public protests.