Government subsidized investments- The Good, The Bad and The Ugly

28th Jan 2024

The Good

The government has two levers Taxation & Interest Rates to nudge the behavior of its citizens and to incentivize long term financial security.

There are three times the government provides Tax Breaks to the investors of its subsidized schemes

- Income Tax is not applicable to the funds allocation to these funds. Usually capped to a few lakhs.

- There is no tax on the interest earned as part of these investment, unlike the interest in an FD or a bank account.

- And finally, these investments are not taxable when these accounts are closed and amount withdrawn.

Hence, these investments are called the Exempt-Exempt-Exempt (EEE) investment. The interest rates on the Fixed interest EEE schemes are historically higher than those offered by Bank FDs by anywhere from 0.1% to 0.5%. As of Jan 2024, the bank FDs typically offer 7% on a medium term of 3-5 years, which after tax comes to ~5%. This would be a solid 2.1% lower than a 7.1% interest offered in something like a PPF, with the interest being non-taxable.

You should also note that as the government moves to the New Income-tax Regime, these investments are expected to become Tax-Exempt-Exempt (TEE), but it would make sense to use the EEE policy as long as it exists.

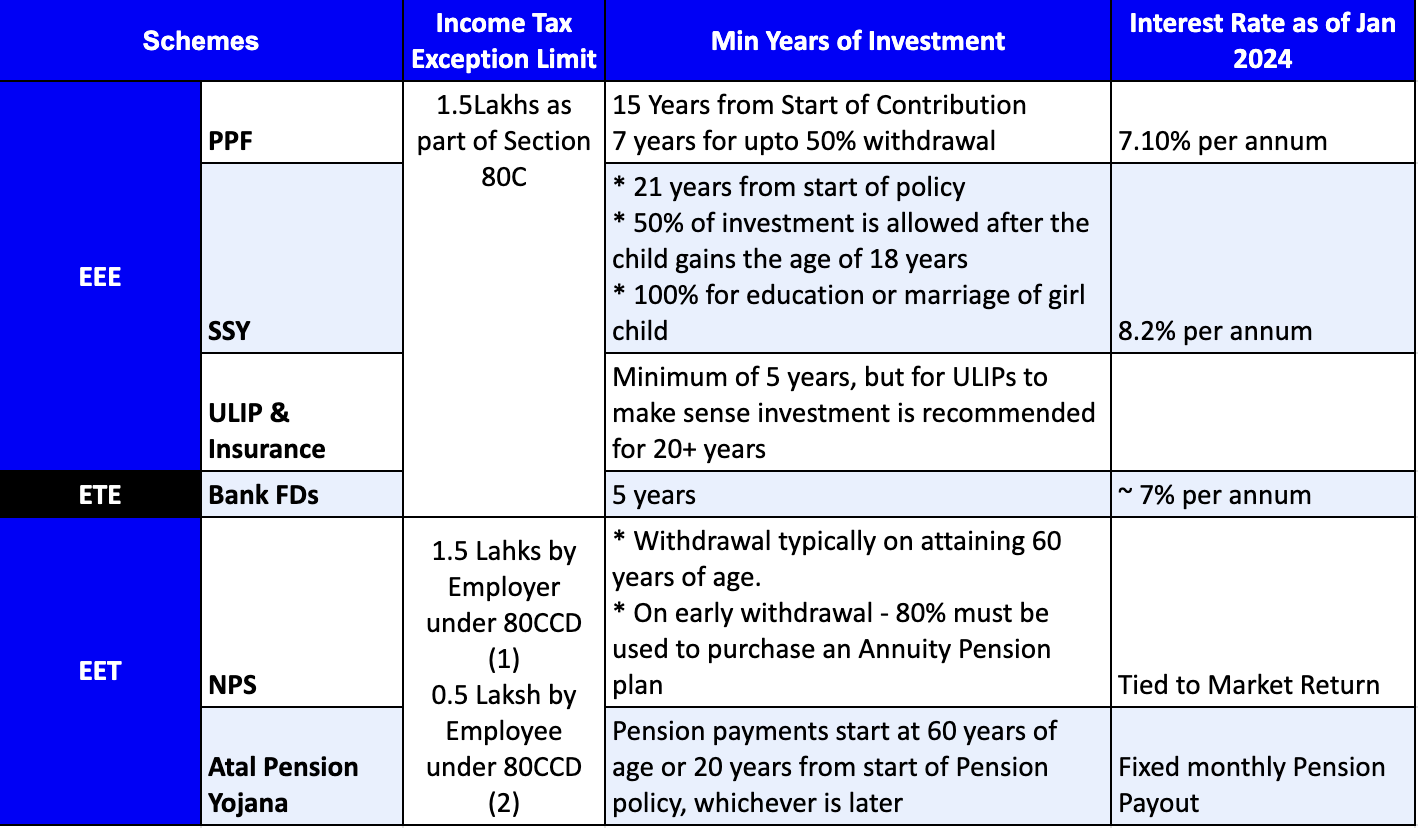

Let’s look at the schemes being offered in some detail in the tables below. The returns are going to be substantially higher than investing in FDs or Mutual Funds, if you can deal with the BAD.

The Bad

These are really LOOOOONG term investments, which means that they should ONLY be considered if you have the Basic Emergency funds we discussed earlier in place. Also, if you are working towards saving for an expected future expense such as buying a house, car, etc., maxing out the investments will only delay your goals.

There are also restrictions on how the funds are to be used after withdrawal as in the case of NPS, SSY schemes, etc.

Before you max out these investments, you must really think about your priorities.

The Ugly

Ever been to the provident office before? Be ready to jump through some serious bureaucratic hoops to get your money out. But I guess, you will be retired by then and can spend a few days dealing with the red-tape.