Are Private Banks the New Haven for volatile times?

9th June 2024The Indian stock market has experienced significant volatility in recent weeks. Sectors heavily reliant on government capital expenditure, such as defense, power, and infrastructure, witnessed a surge in the past 10 months, with returns often doubling or tripling. However, any indication that these companies might fall short of market expectations could trigger swift corrections, as seen on June 4th.

With the recent clarification on the continuation of the NDA government, seemingly stronger than initially anticipated, a question arises: Are we back to square one? Investors, not traders, should be considering strategic asset reallocation. These high-risk investments can be rebalanced towards alternatives with attractive valuations.

Research reports from firms like Goldman Sachs highlight private banks as a sound investment. These established and profitable institutions have reached multi-year valuation lows despite displaying record revenue and profitability growth.

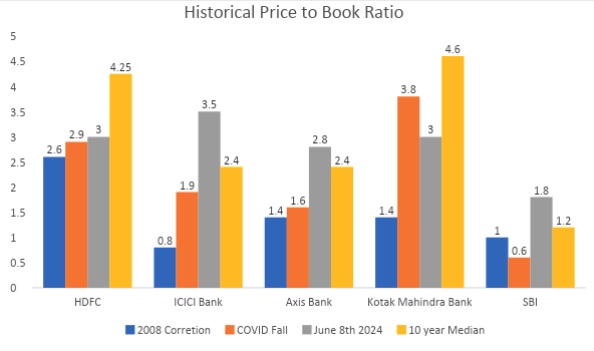

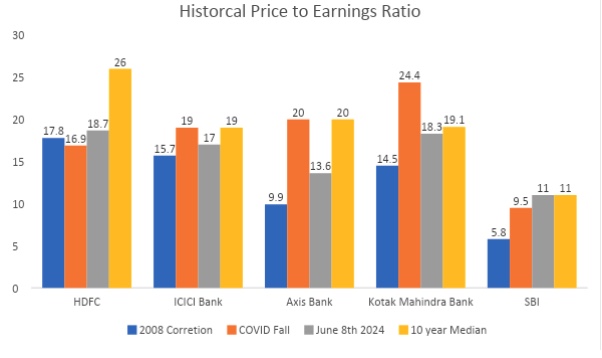

Analyzing historical Price-to-Book (P/B) and Price-to-Earnings (P/E) ratios reveals that many private banks are trading at levels last seen during the 2008 market crash and the 2020 COVID-19 crisis. For example, HDFC Bank's current P/B ratio of 3 is comparable to the 2.6 and 2.9 levels observed during the 2008 crash and the COVID-19 pandemic, respectively. This is significantly lower than the 1-year median P/B ratio of 4.25. Similar trends are evident for other private banks.

Remember: Before making portfolio adjustments, thoroughly assess your risk tolerance, investment goals and exposure to asset classes such a REITs, Gold, Bods, etc. Consult a financial advisor for personalized advice specific to your unique situation.