Decoding real estate investments - Financial perspective

12th Feb 2024One thing Indians all over hate is paying rent. One of the earliest financial goals for most young adults is to save enough to down-pay for an apartment. Today let’s talk numbers and try to figure out what are the financial returns of a few real estate investments and hopefully figure out what would make sense.

Let’s look at the most common real estate investment – residential properties.

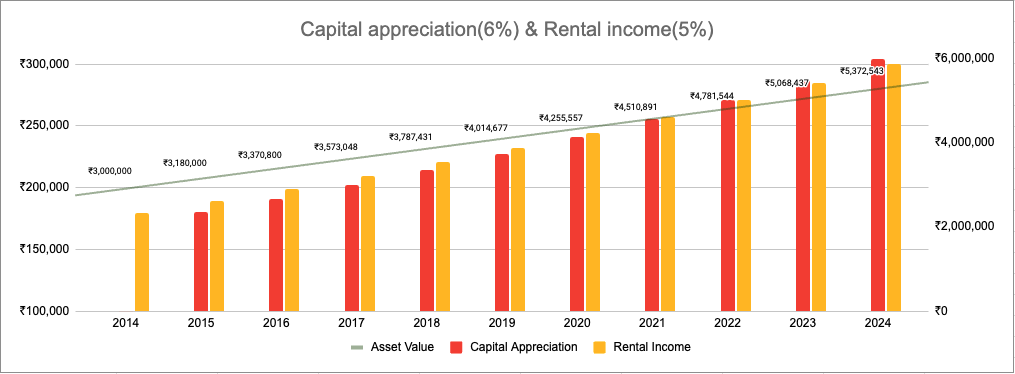

There are two aspects of returns from any real estate investment

- Capital appreciation

- Rental Income of the property is let-out (or) the money not-spent of rent by living in your own property.

The capital appreciation for apartments in metro’s over the last 10 years tends to be typically 5%-6% compounded annual growth rate.

As an example; if Rs. 30 Lakhs was invested in a 2 BHK apartment 10 years ago in an apartment, its value will be a maximum of Rs 50 Lakhs today.

There are of course scenarios where annual raises can be as high as 15%-20% like if a new highway is built very close to a property.

The rental income for an apartment of ~ Rs 50 lakhs today will be approximately 28,000 – 30,000 a month which again comes to an annual return of ~5%.

The consolidated return turns up to be about 10%-11%.

Not as much as you would expect. But are we recommending not to invest in residential properties?

Well, the answer is No! And the reason is Leverage!.

Leverage – which basically means that residential property allows you to borrow money up-to 80% of property value at a rate possibly 1%-2% lower

than the 10%-11% return we get from residential property. You cannot use leverage for equity investment because borrowing cost would be as

high as 14%-20% per annum which is higher than return from equity investment.

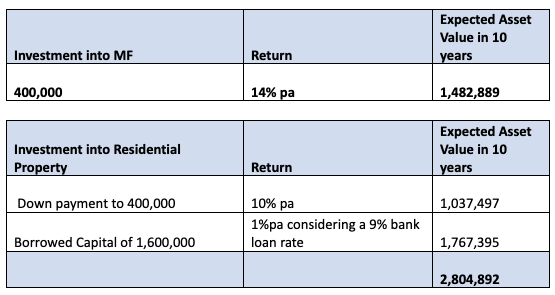

Let’s look at an example.

The asset value of the real estate property is substantially higher than the scenario where the down-payment of Rs 4 lakhs is invested in a mutual fund with a return of ~14% pa.

The difference is the return from investing Rs 16 lakhs which is borrowed as a low interest House Loan.

This also means that one should always use home-loans for purchase of residential property, even if you have the full Rs 20 lakhs available as cash.

Don’t the Tax Discounts offered by the government allowing up to Rs. 2. Lakhs in Home Loan EMI also matter?

Possibly not – since the House rent paid (HRA) can also give you a tax break. Sometimes much larger than 2 lakhs.

Why stop with one? Will it not make sense to invest in multiple properties?

- Ironically, the primary reason is Leverage. Too much leverage to the point where one is unable to pay the monthly installments can drive a person to bankruptcy. Taking this into account, most banks will ensure that the monthly installments for loans do not exceed 40% of the monthly income.

- Secondly, these are fixed assets with very little liquidity, and it can take 6 months or longer to sell and generate cash from these assets.

In conclusion, while investing in real estate has its advantages, it's crucial to consider factors like leverage, liquidity, and the potential returns before diving in. This careful consideration will help ensure that the dream of owning property does not turn into a financial nightmare.