Pay your debt or Invest?

6th January 2024Should you pay off your debt or start investing?

That's the question on the minds of many financial enthusiasts, and it's not always an easy one to answer. How does one decide between paying off debt and investing? Let's break down this process into clear, easy-to-follow steps.

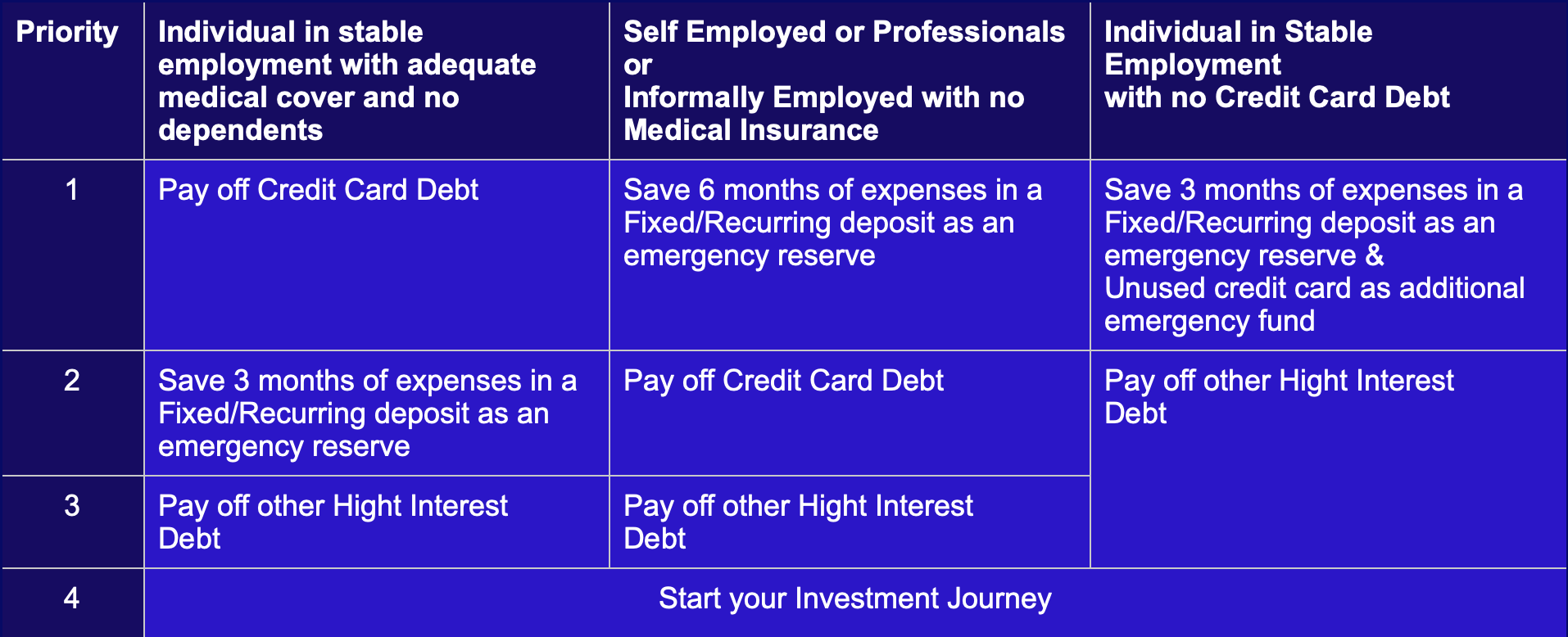

- Consider building an emergency fund. This is a safety net of savings, ideally stored in Recurring Deposits or Fixed Deposits, that can be quickly accessed in case of unexpected emergencies such as job-loss, accidents, or medical emergencies which can drive individuals into crippling debt, bankruptcy and poverty. In an open labor market like the USA, this is particularly crucial due to the potential for job loss, accidents, or medical emergencies. In an Indian context, where formal employment is more stable and medical costs are reasonable, this might be less of a concern. However, for the self-employed, professionals, and those in informal employment, the need for an emergency fund is paramount.

- Focus on paying off overdue credit card debt. Carrying credit card debt can be a costly endeavour, with interest rates often reaching around 42% annually. If you have a debt of ₹20,000 on your credit card, you could end up paying about ₹30,000 in just one year.

- Look at other high-interest debts you may have, such as unsecured personal loans and gold loans. These can also have a wide range of interest rates, usually between 12% to 25% with lower rates typically being offered by PSUs.

Long-term debt, such as home loans and educational loans which are often subsidised by the government with income-tax discounts should not be a priority over investments at this stage.

Case study

In summary, deciding between paying off debt and investing involves considering several factors, from the need for an emergency fund to the types of debt one needs to pay off. It's a complex decision-making process. Please do your own analysis or take independent professional financial advice before making any investments based on your own personal circumstances.