ULIP – Real Returns & Hidden Costs

22nd Jan 2024

Continuing our discussion on investment in "Insurance" products , let's delve into the realm of ULIPs.

ULIPs are among the most intricate investment products in the Indian market, offering Mutual Fund-style returns while providing the security of Life Insurance.

In the past, ULIPs were often exploited by retail investors until the implementation of regulations by IRDAI in recent years. There is a wealth of information available on the various types of ULIP charges, which can be found HERE and HERE, but we won't go into detail about them again. Instead, we will touch upon a few key points regarding the most significant charges.

Premium Allocation Charges in ULIPs

This is the most detrimental fee as it has the greatest impact on the returns you will receive.

Essentially, if you invest Rs. 100 and there is a Premium Allocation charge of 5% for the first 2 years,

you will only be investing Rs. 95 each year. However, nowadays, there are ULIPs available with Zero Premium Allocation Charges.

Fund management charges

This is a fee that is common to any Mutual Fund, where a percentage ranging from 1% to 2% of the fund value

is deducted as fees for managing the investment portfolio.

Mortality charges

This is similar to the premium for the life insurance component of the ULIP.

Case study: ULIP vs MF & Term Insurance

Let's compare the returns of a ULIP with a Mutual Fund and Term Insurance combination.

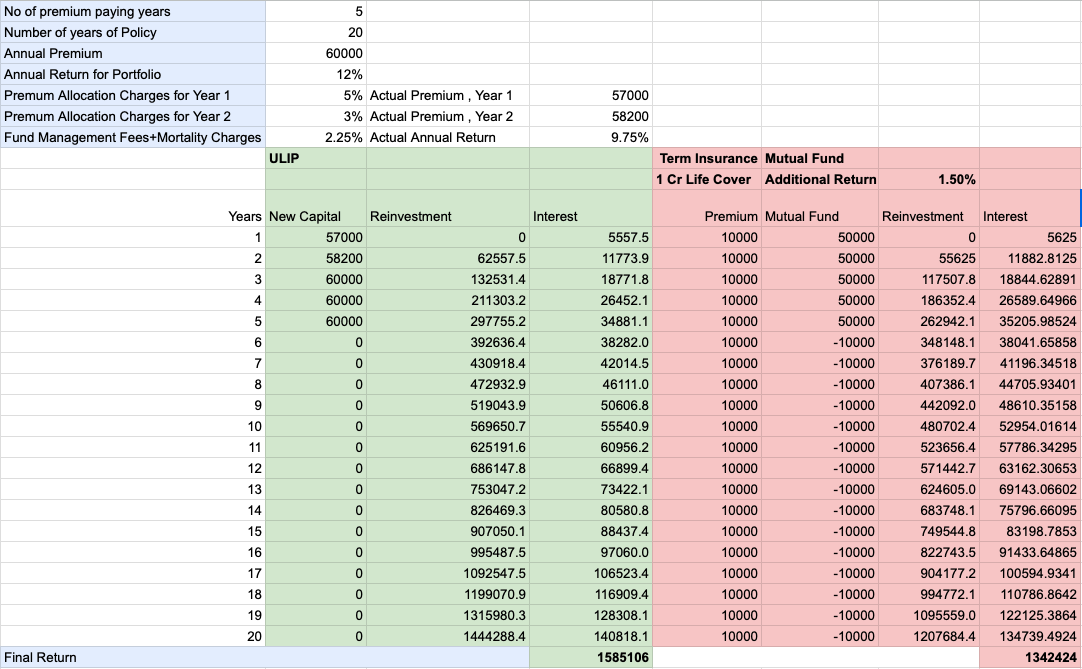

X invests ₹60,000 annually for 5 years in ULIP .

Y invests ₹50,000 annually for 5 years in a Mutual Fund and ₹10,000 in Term Insurance. The Mutual fund has 1.5% higher annual returns than the ULIP.

Despite ULIPs being a complex product, it may not be a bad bet after-all.