Wealth Creation 101

30th Dec 2023Have you ever wondered how to start the journey towards wealth creation?

The answer lies not in a single giant leap but in a series of small, consistent steps.

- Without a doubt, income stands as the most crucial contributor to wealth creation. This principle applies to everyone, from young adults embarking on their careers to those who are well into their work lives,with a few exceptions for those whose investment returns are already providing a comfortable lifestyle.

- Assuming your income is something which is going to gradually increase, the next step is to increase the disposable income which can be set aside for investment. Here, budgeting plays a pivotal role. The goal is to save approximately twenty percent of your take-home income. A hidden ten percent savings often comes in the form of Provident Fund contributions, further bolstering your wealth creation potential.

- Final step involves generating additional income by smartly investing your existing assets/savings.

Best practices - Case study

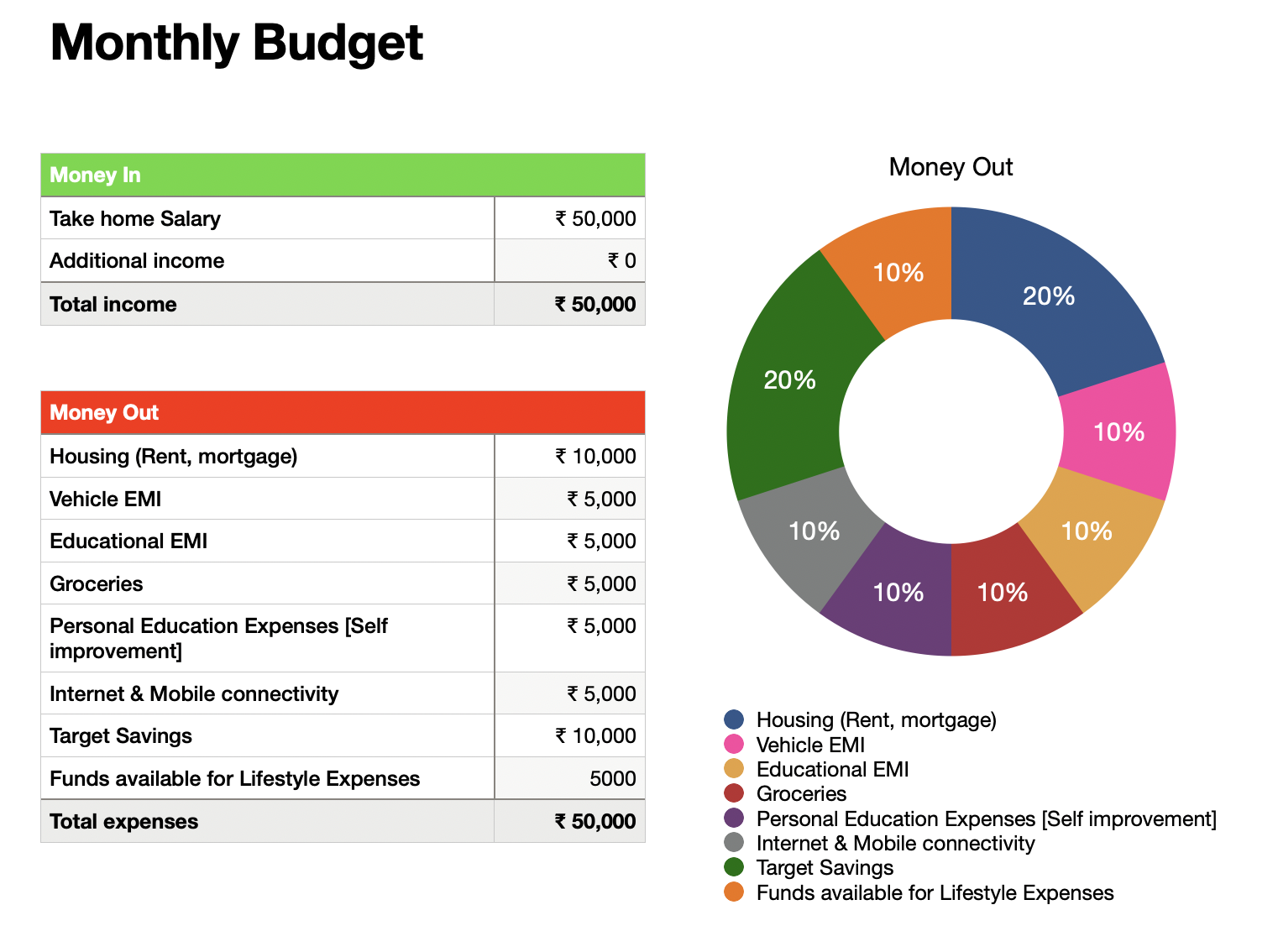

Consider a single, 24-year-old individual who has just started their career with an approximately 7.5L to 8L annual income and a take-home monthly salary of Rs.50,000.House Rent - 10,000

Vehicle EMI - 5,000

Educational EMI - 5000

Groceries - 5000

Personal Educational Expenses - 5000 - which will help you increase your skills and potentially increase your future income. This can potentially be savings for a planned additional diploma or a degree as well. Although this is an expense, it will give you the maximum return and more important than the saving target for the individual.

Internet & Mobile Connectivity - 5000

Whatever is left over will be split across Savings & Optional Lifestyle Expenses. The point is to set-aside your savings targets before spending money on the Lifestyle Expenses.

Target Savings - 10,000

Which leaves Misc Lifestyle Expenses - 5000

The practice will be to invest the Target Savings of Rs.10,000 as soon as the money hits the bank. For simplicity lets assume this is an Recurring Deposit or a SIP with a Mutual Fund. The choice of investment is a separate topic of discussing which we will get into in future.

And lastly, track your daily expenses. Utilize budgeting tools, like our Mishree App, to ensure you live within your means.

And there you have it - you've taken the first step towards long-term wealth creation. Remember, it's not about the speed, but the direction. Steady, consistent steps will lead you towards financial prosperity.